Modern Portfolio Theory and Optimization with JAX

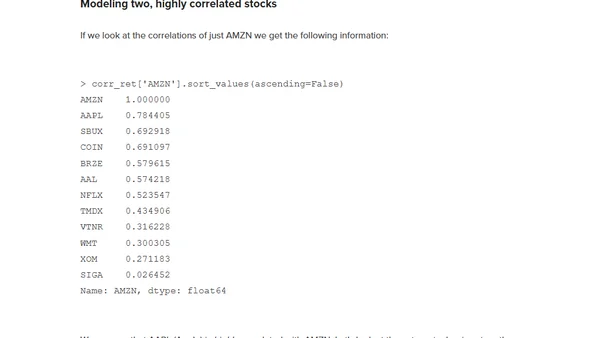

Read OriginalThis article provides a deep dive into Modern Portfolio Theory, explaining how to model stock price movements and optimize asset allocation. It demonstrates the process using JAX for differentiable programming, covering data transformation to log returns, modeling with multivariate normal distributions, and solving the optimization problem to balance risk and reward.

Comments

No comments yet

Be the first to share your thoughts!

Browser Extension

Get instant access to AllDevBlogs from your browser

Top of the Week

1

Quoting Thariq Shihipar

Simon Willison

•

2 votes

2

Using Browser Apis In React Practical Guide

Jivbcoop

•

2 votes

3

Top picks — 2026 January

Paweł Grzybek

•

1 votes

4

In Praise of –dry-run

Henrik Warne

•

1 votes

5

Deep Learning is Powerful Because It Makes Hard Things Easy - Reflections 10 Years On

Ferenc Huszár

•

1 votes

6

Vibe coding your first iOS app

William Denniss

•

1 votes

7

AGI, ASI, A*I – Do we have all we need to get there?

John D. Cook

•

1 votes

8

Dew Drop – January 15, 2026 (#4583)

Alvin Ashcraft

•

1 votes